US$59bn Netflix bridge loan sets stage for blockbuster year ahead

Netflix is backing its planned US$82.7bn acquisition of Warner Bros Discovery's TV and film studios and streaming division with a US$59bn bridge loan, viewed by the banking community as a signal that more large M&A deals will make their way to debt capital markets in 2026.

Taking a position: AI debt frenzy gives birth to new CDS markets

Until recently, the idea of Meta Platforms going bust seemed so fanciful that no real market existed for traders to exchange bets on such an outcome.

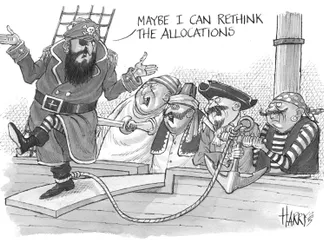

Hans-Joerg Rudloff: a swashbuckling pioneer who shaped modern banking

Hans-Joerg Rudloff, widely regarded as a titan of the bond market and a man who for half a century shaped global finance and several institutions around his vision, died on December 1 aged 85.

Anchor investors storm out of Meesho's Indian IPO

Major Indian and global asset managers have boycotted the anchor tranche of Indian e-commerce company Meesho's IPO in protest at what they saw as an unfairly generous allocation to SBI Funds Management, highlighting the challenges bankers face in allocating shares in hot Indian IPOs.

Rupak Ghose

Japanese bond yields have surged in recent days to levels not seen in decades. At much the same time, Treasury yields have eased in anticipation of the US Federal Reserve cutting overnight interest rates.

Until recently, the idea of Meta Platforms going bust seemed so fanciful that no real market existed for traders to exchange bets on such an outcome.

Hans-Joerg Rudloff, widely regarded as a titan of the bond market and a man who for half a century shaped global finance and several institutions around his vision, died on December 1 aged 85.

Canada’s top five banks easily beat earnings expectations in their latest financial quarter as revenue from investment banking and trading surged, sealing a buoyant year that saw several of them gain share on rivals.

Britain has reduced the minimum capital requirement for its banks in the latest evidence that regulators across the world are relaxing rules put in place after the financial crisis – and are putting greater focus on improving lenders' competitiveness compared with US rivals.

Bankers and investors are bracing for a flood of AI-related debt issuance that is likely to change the composition of the investment-grade bond indices and the way the asset class assesses fair value for borrowers higher up the credit spectrum.

Altice International's bondholders were left reeling last week after the troubled telecoms company, with more than €8bn of debt, changed the status of two subsidiaries, putting their assets out of reach of creditors.

Adani Group plans to deepen its presence in India’s local currency bond market over the next five years by increasing private and public issuance, extending tenors and introducing funding products such as securitisation.

India’s bond yields eased after the Reserve Bank of India cut the benchmark repo rate by 25bp to 5.25% on Friday, with inflation at its lowest level in a decade while GDP growth remains resilient.

About US$350bn of US CLOs may be refinanced or reset next year as investors take advantage of tightening spreads across the capital structure to improve returns to investors in the most junior portion of the funds.

German renewables platform Enpal priced its second solar ABS, a €303m transaction that marks a milestone for Europe’s capital markets by bringing heat pump receivables into the public securitisation arena for the first time.

The US asset-backed primary is making a lane for LLP Exotic Auto Finance, which is bringing a rare securitisation backed by leases on luxury and collectible cars.

Melbourne-based nonbank lender BC Invest expanded the Australian CMBS issuer base on Friday with the A$600m (US$396m) BC Invest Voyager CMBS Trust 2025-1.

HSBC has been accused of "climate backsliding" as the bank continues its push to commercialise its approach to sustainability and frame it as a driver of growth.

LondonMetric Property landed a successful debut deal in the sterling market on Wednesday through a £500m dual-tranche green bond offering.

Volkswagen Bank demonstrated the depth of liquidity in the euro investment-grade market even at this late stage of the year, pulling in more than €9bn of peak orders for its €2.5bn triple-tranche senior preferred green bond transaction on Wednesday.

Major Indian and global asset managers have boycotted the anchor tranche of Indian e-commerce company Meesho's IPO in protest at what they saw as an unfairly generous allocation to SBI Funds Management, highlighting the challenges bankers face in allocating shares in hot Indian IPOs.

HashKey Holdings, the operator of Hong Kong’s largest licensed cryptocurrency exchange, is testing investors' appetite for virtual assets in Asia with a Hong Kong IPO that is much smaller than it had hoped.

Iren turbocharged its transition from bitcoin miner to high-performance computing AI mainstay with a dramatic US$3.6bn three-part equity-linked raise on Tuesday that saw it flush dilution from existing CBs that were deeply in the money.

Wealthfront is taking a safety-first approach towards its Nasdaq IPO by selling shares at a very reasonable valuation while securing upfront commitments from BlackRock and Wellington Management.

The world’s largest contract electronics manufacturer is making its debut at the parent company level in the syndicated loan market in Taiwan with a NT$30bn (US$950m) borrowing linked to sustainability metrics.

Netflix is backing its planned US$82.7bn acquisition of Warner Bros Discovery's TV and film studios and streaming division with a US$59bn bridge loan, viewed by the banking community as a signal that more large M&A deals will make their way to debt capital markets in 2026.

European companies are hacking away at a looming wall of 2028 maturities, taking on a mammoth task to help borrowers refinance before conditions turn.

The US$12.25bn financing package supporting Blackstone and TPG's buyout of diagnostic and medical imaging company Hologic includes a US$2bn second-lien tranche, an increasingly rare structure in a market now dominated by unitranche financing.

Read the latest stories from the magazine IFR 2612 - 6 Dec 2025 - 12 Dec 2025

6 Dec 2025 - 12 Dec 2025